Get the home you want with help from pre-rental screening

Finding a place to live in Quebec can be challenging, especially in urban centres like Montréal, where demand is high but supply is low. A wonderful way to put the odds in your favour and get your dream home is to prepare a solid rental application for your future landlord.

Why wait for the landlord to ask you for the required documents and consent to do a pre-rental screening when you can take the lead and do it yourself? Preparing in advance can give you a significant edge in the competitive rental market.

What should be included in the rental application?

The rental application should include all the documents you have to submit to the landlord to prove that you’ll be able to pay your rent and that you’ll keep the dwelling in good condition.

A rental application normally includes the following documents:

- A photo or non-photo ID (driver’s license, medicare card, etc.)

- Proof of current address (driver’s license, Hydro-Québec bill, etc.)

- Former landlord references: the future landlord may ask for the names and contact information of former building managers or landlords to verify a future tenant’s prior behaviour in terms of respecting the property. An effective strategy would be to take the initiative of preparing letters of recommendation in advance.

- Documents that indicate your ability to pay (credit information from a financial institution, a credit report from the credit bureau, proof of employment, etc.)

|

Tips and tricks To protect your personal information, the landlord cannot collect your ID , for example by taking a photo or making a copy. Your only obligation is to show it when they ask. Your social insurance number is not mandatory for the verifications, but it does make it easier to access your credit information more quickly, and to avoid mistakes about your identity. Finally, the landlord must obtain your consent before carrying out any verification such as a credit check. |

Why get pre-qualified with a pre-rental screening?

In Quebec, it’s still quite rare for tenants to do their own pre-rental screening, for example by obtaining their credit report form Equifax . Tenants usually expect the landlord to request authorization and then do the verifications. However, a new self-qualification option is now available on Centris.ca , and it offers many advantages.

Maintain control

Gathering and verifying your own personal information minimizes risks related to unauthorized disclosure and ensures immediate transparency with your landlord. Taking information directly from relevant sources, such as your credit report or judiciary record, allows you to securely manage your information and ensure it stays confidential.

In taking this approach, you can rest assured that your personal information will remain protected throughout the rental process and that you will retain full control over it.

Save time

Doing your own pre-qualification can also save you a great deal of time when you’re looking for and choosing an apartment. Preparing all the documents you need in advance can help you avoid potential delays caused by incomplete applications or missing information.

This proactive approach can also reduce the overall time it takes to submit your application, thus increasing your chances of being among the first potential tenants to be considered. Also, with all the required elements on hand, you’ll simplify the process for landlords and property managers, which can speed up the decision-making process and help you secure the housing of your choice faster.

Demonstrate reliability

When a prospective tenant does a proactive pre-rental screening, they’re showing the landlord that they’re prepared, pay attention to detail, and can efficiently manage the rental process. Gathering all the required documents and relevant information in advance shows a willingness to cooperate and a good grasp of the landlord or property manager’s expectations. It presents an image of a tenant who is reliable, responsible and prepared to comply with the established requirements and timelines.

Understand your financial situation

Having a thorough understanding of your financial situation is crucial. For many people, a credit check is an unfamiliar and frequently neglected step. However, it’s essential in understanding how your financial history can affect your ability to obtain rental housing.

Knowing your financial situation is a beneficial exercise in adopting the right strategy for your future projects, especially if you hope to buy a home someday.

Get prequalified with Trustii pre-rental screening

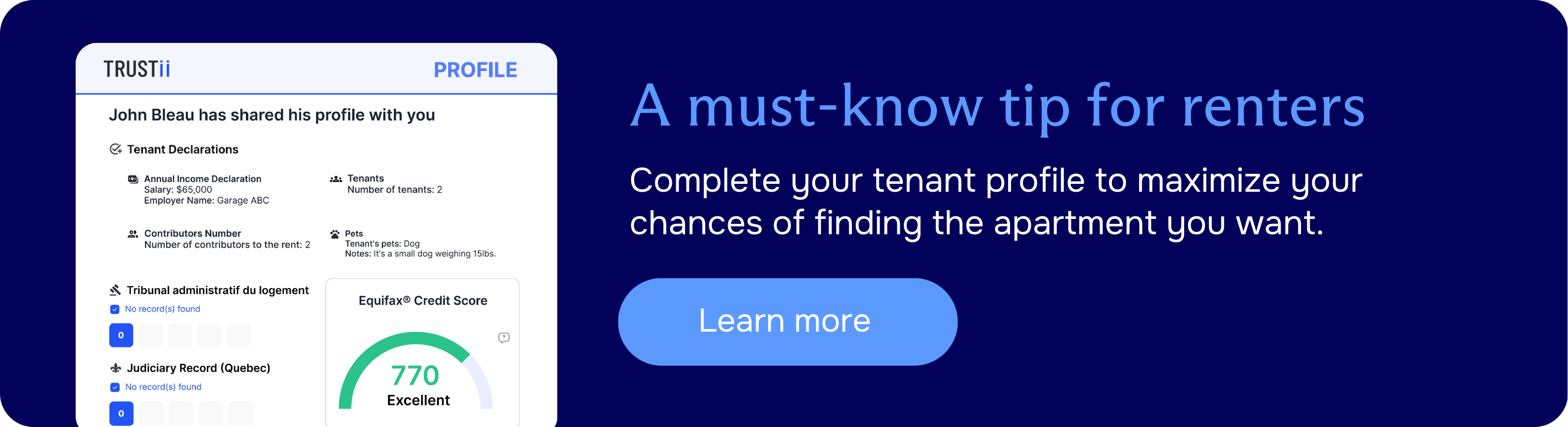

The most efficient way to conduct pre-rental screening on your own is to use a centralized service such as Profile, Trustii’s self-qualification platform. This platform lets you gather, manage and share the information you’ll need during the rental application process. Tenants can select from a menu of verification options, such as credit score, TAL file and criminal record. Results are ready in just a few minutes, unlike traditional methods, which can take up to 48 hours.

They can also enhance their verification process with a self-declaration, where they provide key details like the number of occupants, payers, income, and whether they have a pet.

After obtaining the documents, Trustii generates a report that’s easy for landlords to understand, which you can then share with the desired recipients as many times as you like. This allows you to maintain control over who has access to your data while also allowing you to share the same report with multiple landlords. Landlords will have quick access to the necessary information.

|

Tips and tricks You can access the pre-rental screening directly on Centris.ca. Just go to the Rent tab and select Pre-rental screening. If you already have an account , go to your tenant profile. |

Find the perfect apartment with pre-rental screening

In conclusion, preparing a complete rental application is a crucial step for any tenant hoping to secure their ideal home. Taking the time to get pre-qualified will enhance your credibility in the eyes of landlords and help you anticipate and resolve potential problems before they become barriers.

With a proactive approach, you can more effectively navigate the competitive rental market, thereby increasing your chances for success and ensuring a positive, less stressful rental experience. Now that you know all about rental applications, you’re ready to create your tenant profile and look for a rental property on Centris.ca!

FAQ

1. Do landlords often ask for a credit check and other background checks during the rental process in Quebec?

Yes, it’s quite common for landlords and property managers to request credit checks and other background checks in Québec. It helps them assess the solvency and reliability of potential tenants and make informed decisions about renting out their property.

2. How does Trustii protect my personal information?

Trustii uses advanced security measures to protect tenants’ personal information. Data is securely encrypted and stored in compliance with the highest security standards, such as SOC 2 Type II.

3. How do I know if I have a good credit score?

Using Trustii to get your credit report will give you access to your credit score so you can assess your credit situation. Many factors can affect your credit, but if there are any potential issues with your application, you can find out in advance and proactively explain them to future landlords.

Article written in collaboration with:

Trustii is a major player in the industry of automated background check services and intelligent solutions for people risk management. It offers a platform adopted by Canadian leaders in property management, as well as by HR, risk management and compliance teams in companies of all sizes. Trustii supports these organizations in reducing people-related risks and creating safe environments. To find out more, visit trustii.co.

See also:

First time renting an apartment: a step-by-step guide

What moving expenses can you claim?

I’m moving: to whom should I send my change of address?

The Largest Number of Homes for Sale

The Largest Number of Homes for Sale